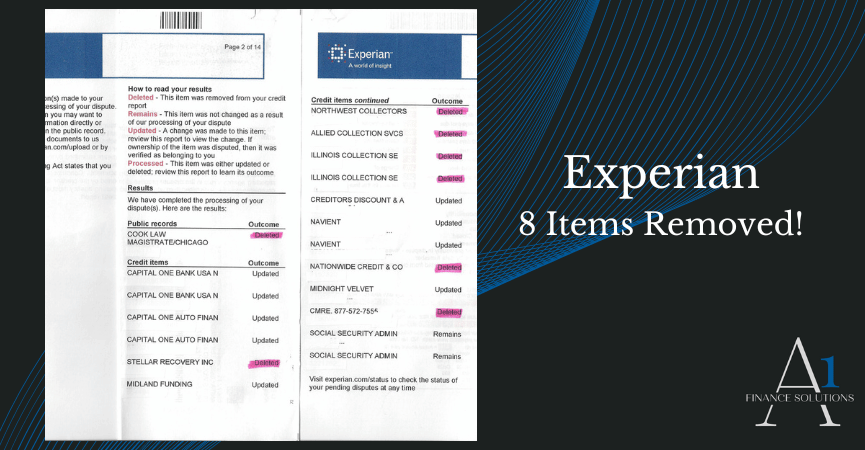

Experian

- Home

- Experian

About Results

Every credit report is different and so results vary from client to client. Only items that are inaccurate, unverifiable, and obsolete can come off a credit report when challenged. If an item is accurate and can be verified, it can remain on the report until it is time for it to come off the report.

It all comes down to whether or not the items on the report are meeting all the requirements outlined in the Fair Credit Reporting Act for them to continuously be reported. If they aren't or cannot be verified within a reasonable amount of time, then by law, they must be removed.

We have removed the following types of inaccuracies from people's credit reports:

- Bankruptcies

- Foreclosures

- Repossessions

- Late Payments

- Charge Offs

- Collections

- Judgments

- Tax Liens

- Inquiries

Improving your credit is something you will want to do. Studies show that people who live with poor credit their entire lives, spend almost $200,000 over their lifetime than someone with good credit. Having improved credit can help you save on the following:

- Credit Card Interest Rates

- Home Loans

- Auto Loans

- Car Insurance

- Life Insurance

Paying your bills on time accounts for 35% of your credit score. Try not to overextend yourself when taking on credit will help you in paying your bills on time.

Revolving debt accounts for 30% of your credit score. Paying cards off regularly will ensure that you are saving money on interest and giving you the biggest chance at having a better score. Try not to charge more than 30% of the limit at any one time and pay cards off 30 days prior to applying for a new loan.

If you have credit cards, be sure to keep them open even if you are not using them. Try to use them once every 6 months to keep them actively reporting on your report, however, closing the account will lower your utilization ratio and the longer an account is open on your credit file, the better it is for your credit. The length of your credit history has an impact of 15% on how your scores are calculated.

Create an emergency fund in case a life event happens, you can rely on the savings and not on credit.